Part One - Why war is waged

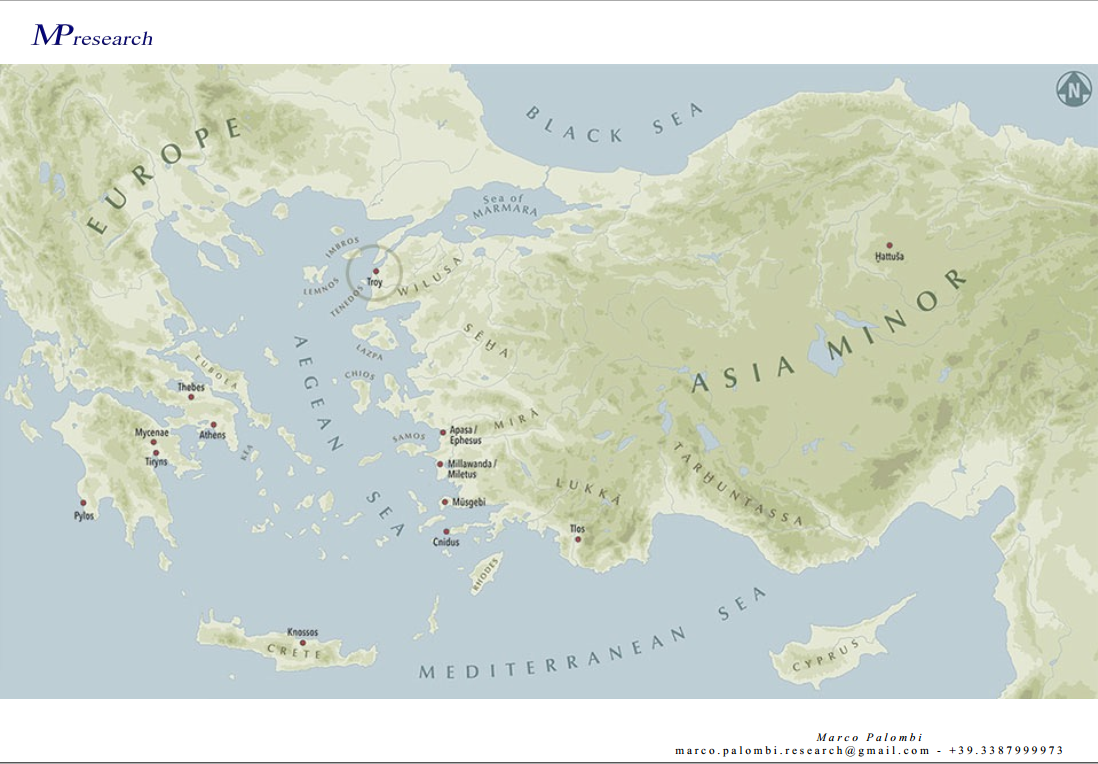

In wars, a ruthless truth is revealed: behind the banners of ideology and honor, the real movements echo - a relentless quest for domination over resources and peoples. The Trojan War, a timeless epic, was not a mere clash of swords and shields; but a deep mercantile rivalry, as the Trojans held the crucial sea routes, giving rise to a conflict that resonates through the centuries.

A key element to take into account is the dynamics of climate change, which involves the retreat of Arctic glaciers. This makes the Northern Sea Route passable with less effort for a longer period of time throughout the year. Researchers and economists usually compare the Northern Sea Route with the conventional Suez Canal Route. The first route is shorter, which saves on fuel, there are no duties for passage; There is no risk of pirate attacks and, as a result, there is no need to secure the cargo. Thanks to the progressive melting of the Arctic ice and the extensive study of the polar routes, the traffic of goods is growing steadily every year. In addition, navigation on that stretch of sea is managed directly by Russia. The State Corporation Rosatom assumes responsibility and functions for the Northern Sea Route and ensures the safety of navigation at a high technological level. But with the war in Ukraine, and the consequent hardening of the Baltic countries,

as well as Sweden's entry into NATO, this supremacy can be questioned.

On May 17, 2023, a significant article appeared in "the Moscow Times" titled "Iran and Russia sign agreement to complete a major transport network" By April, in fact, it was already known that Moscow had started exporting petroleum products to Iran for the first time after its major buyers stopped importing Russian fuel in the wake of the invasion of Ukraine. Both subject to severe Western sanctions, Russia and Iran have increasingly traded with each other in order to keep their embargoed economies afloat. While Russian Deputy Prime Minister Alexander Novak announced that Iran would start importing Russian oil in the fall, the first deliveries began earlier this year. In February and March, Moscow supplied up to 30,000 tons of gasoline and diesel to Iran by rail through Kazakhstan and Turkmenistan. Iran and Russia agreed in May to cooperate on the construction of the last part of a commercial transport network linking the Gulf and India, avoiding western sea routes.

Second part - A Taste of Economic Warfare: Embargoes

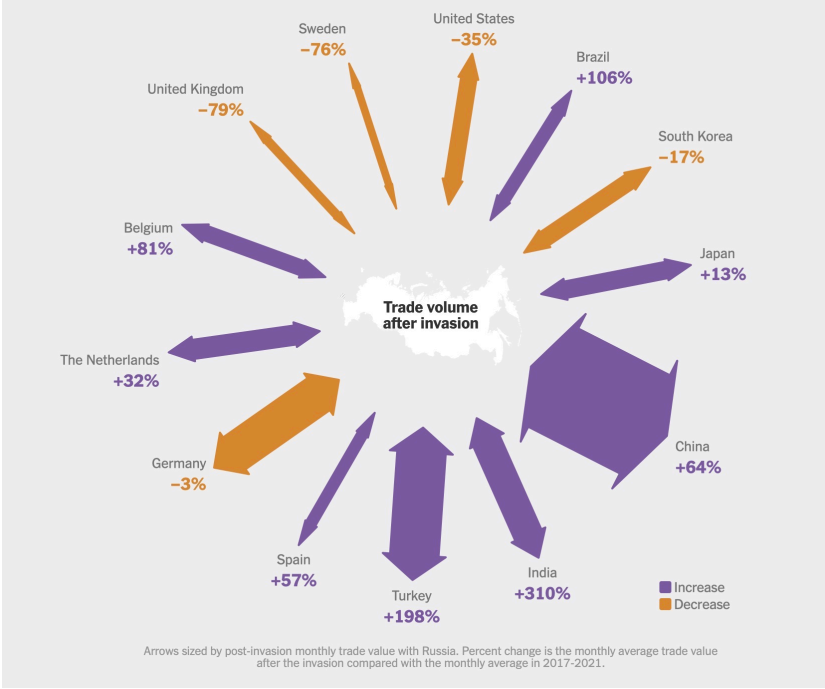

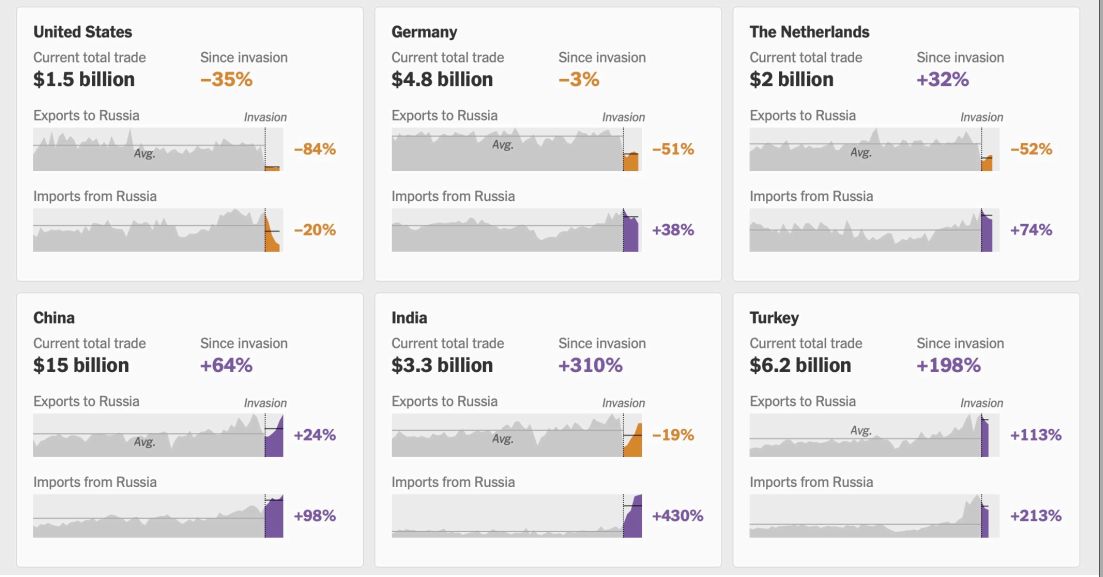

Hypothesis: The embargo affects your allies more than your enemies.

Thesis: Enemies are accustomed to doing without your economic and technological cooperation, while your friends are not; your enemies are accustomed to developing alternative commercial and financial relationships, your friends are not. Prescription lists too, since they create allies' dependence on the partner with greater investment capacity.

Demonstration: Embargo on Cuba since May 14, 1958 as yet.

By 1948, the U.S. government had begun to control the cooperation span of its Western European allies for a coordinated technology embargo policy against the communist bloc. At that time, COCOM (Coordinating Committee for Multilateral Export Controls) was founded.

On April 12, 1961, Yuri Gagarin became the first man in space.

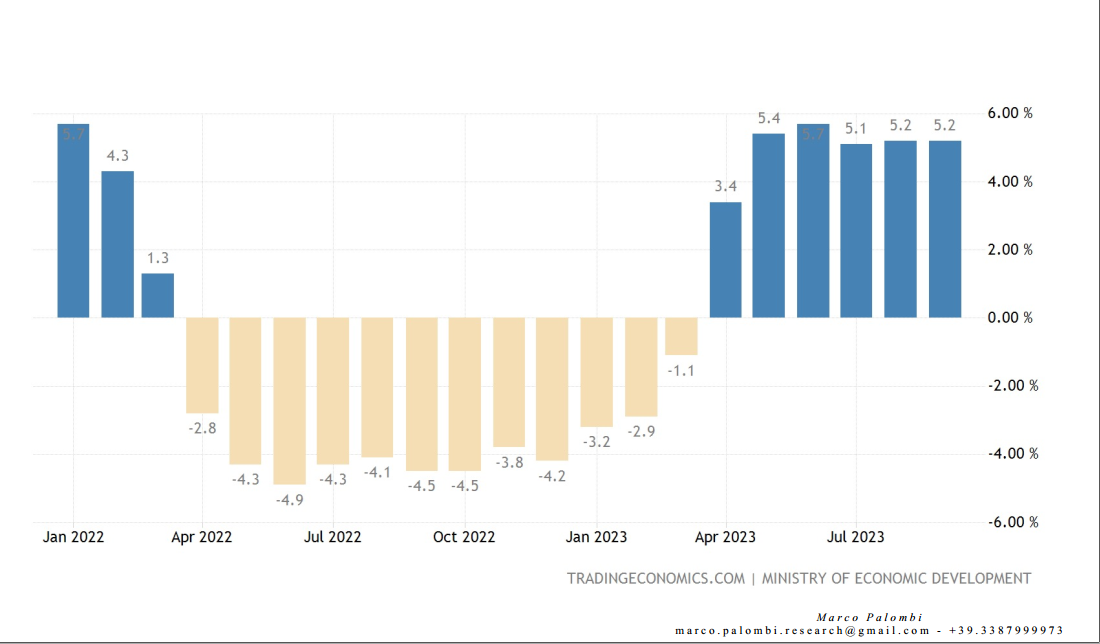

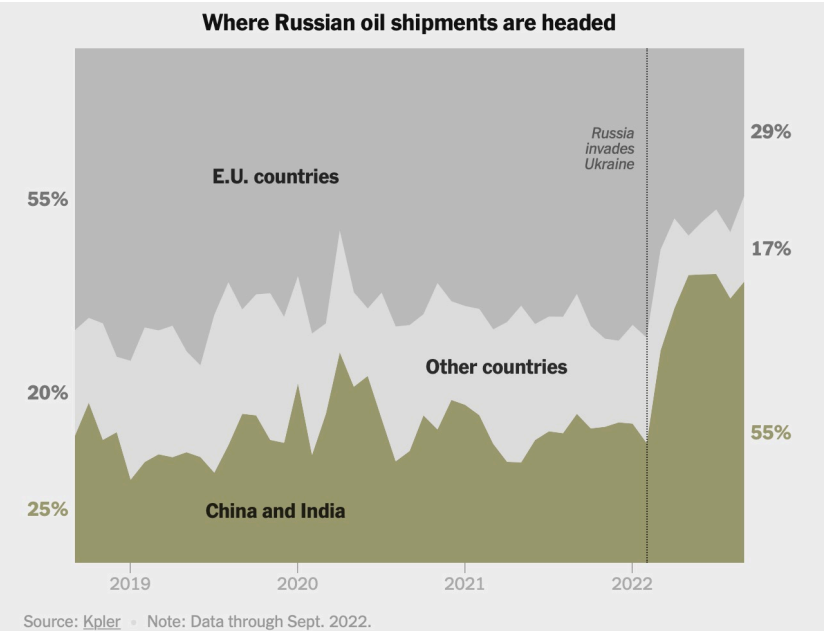

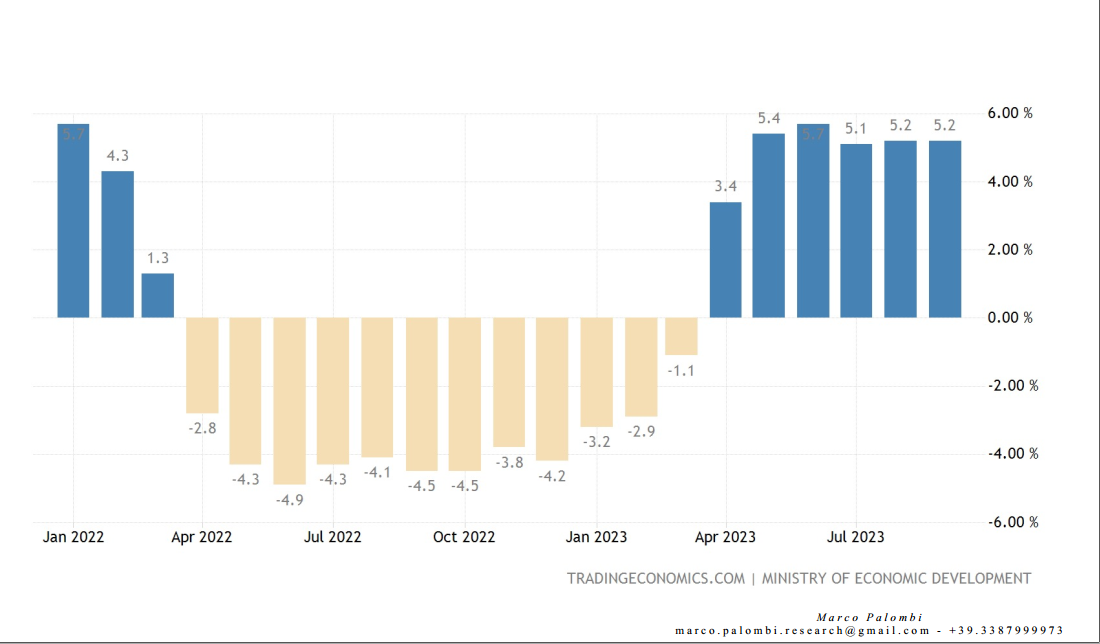

Effects of the Western embargo following the Special Operation in Ukraine Russia – changes in GDP

Russia: Foreign trade

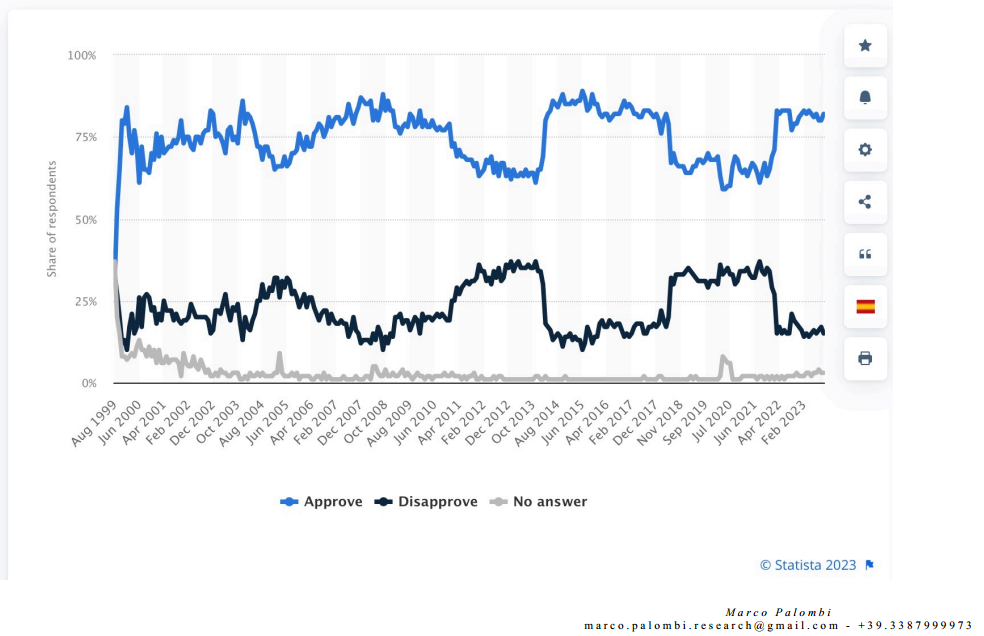

Do you approve of the activities of Vladimir Putin as the president (prime minister) of Russia?

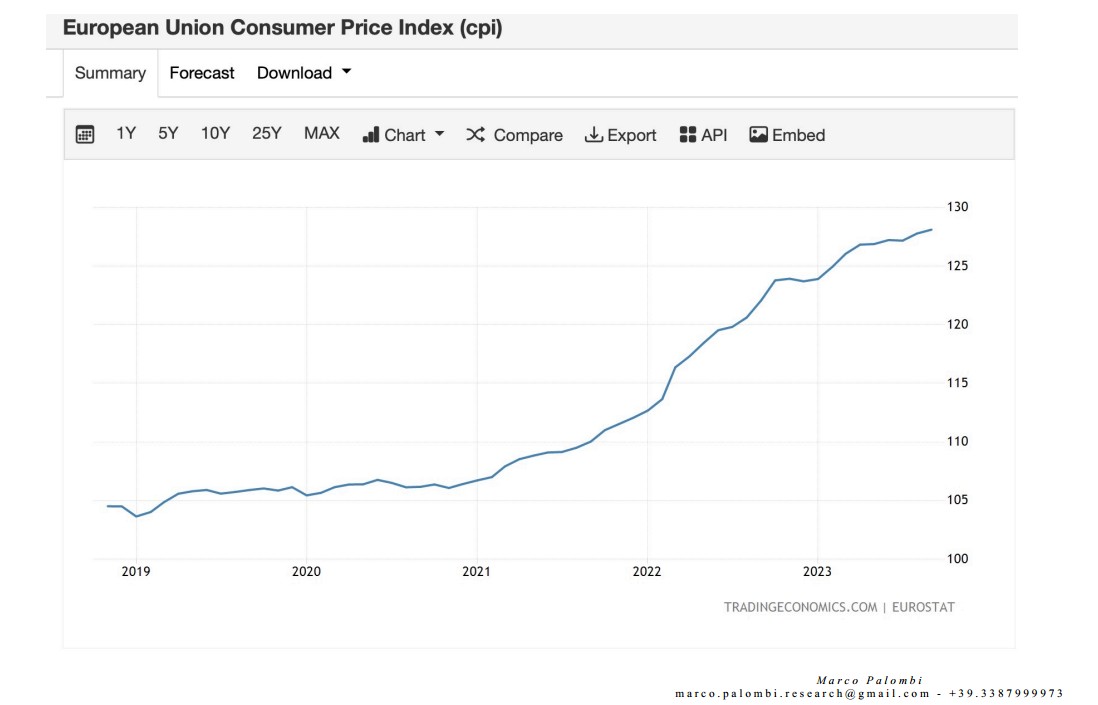

European Union GDP growth, trends

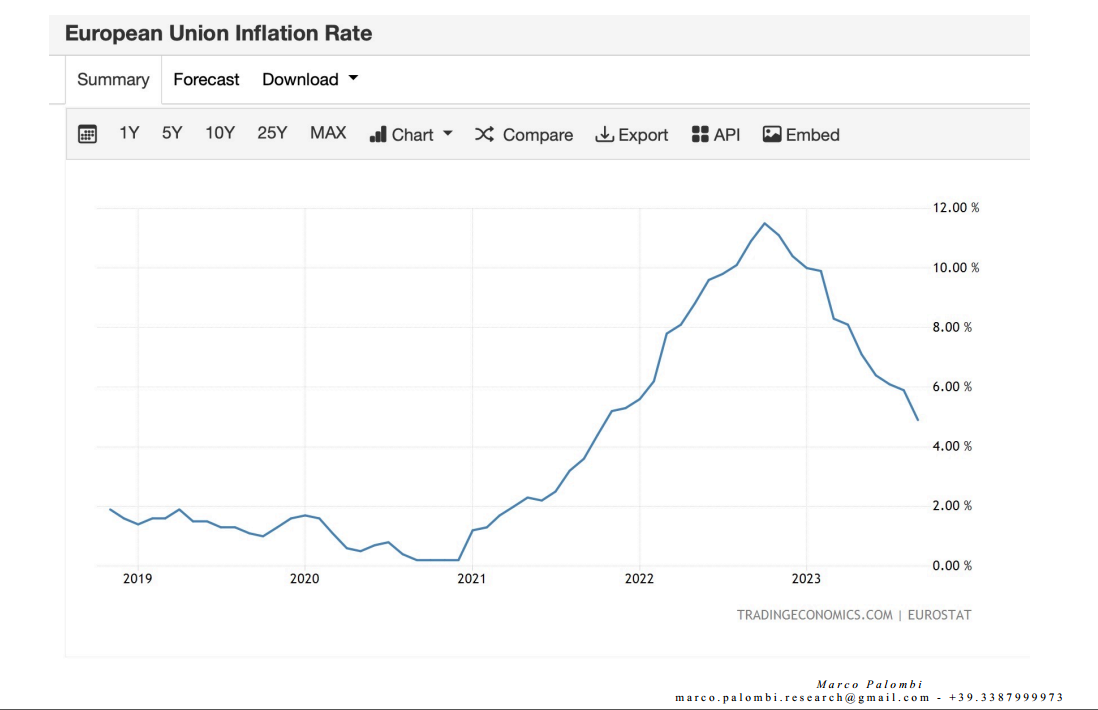

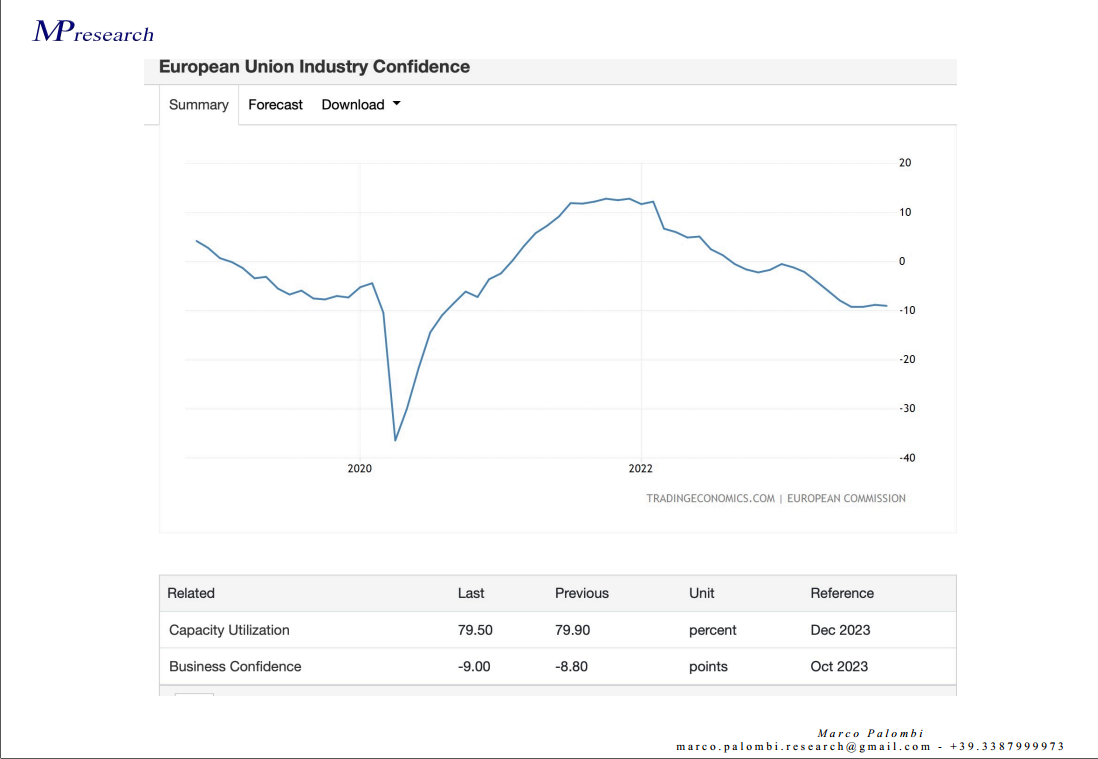

In the EU, Inflation is declining thanks to the convergence of restrictive ECB monetary policies and declining demand for processing goods

(given lower output growth), while consumer prices are rising due to companies' need to offset the cost of capital and perhaps an even

more worrying factor: the trend towards divestment. In fact, the confidence index in the manufacturing sector in Italy fell to 97.8 in August 2023. This represents a decline from the downwardly revised figure of 99.1 in the previous month and is the lowest level since January 2021. The index was below market expectations, which had predicted stability at 97.8.

Third part - New Ways of Waging Economic Warfare

Yuan-li Wu – a specialist in Chinese economic history trained at the London School of Economics and lecturer at Stanford, late (1969-70) Deputy Secretary of Defense – defined that Economic Warfare consists, in essence, in the definition of a specific Economic Statecraft and Foreign Economic Policy. In a 1952 book, Wu defined the Economic War «the use of all those international economics measures which directly enhance a country’s relative strenght», consisting mainly of 'long-term measures' for the purpose of 'penetration' and 'attachement'.

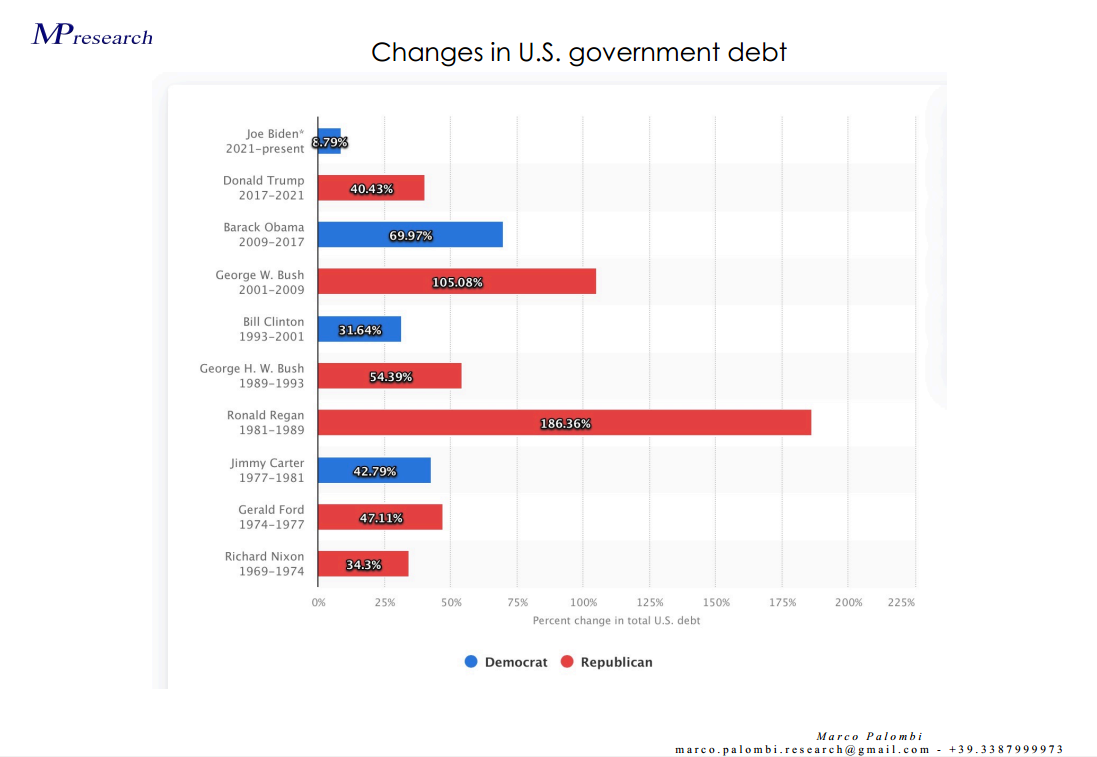

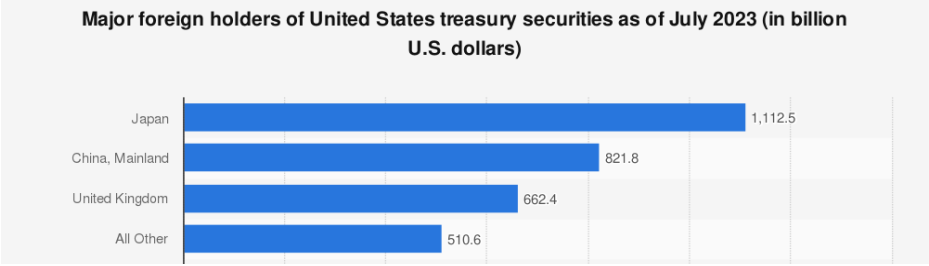

U.S. public debt used as a Trojan horse to influence the monetary policies of foreign countries.The monetary leverage is essential to ignite and master the growth of a Nation. Steady growth leads to Development, if the earnings are re-invested into an economic system that enhance

the self-sustaining growth, with R&D among others. When the Development involves the improvement of the Nation’s people life conditions, it is Progress. Without the Monetary leverage it is impossible to ignite nor to manage growth efficiently. If an important portion of the wealth of a Nation is quoted in unliquid foreign currency, the Central bank has limited room for manoeuvre. Especially if this currency is USD, which use is unavoidabile in the international trade. If you want a grant, a BG, an SBLC in USD, better you have USD securities in your wallet.

The reaction:

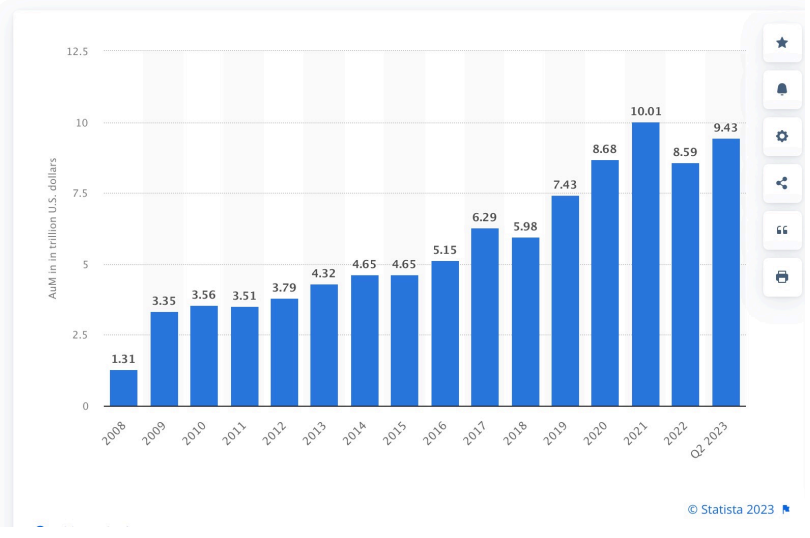

Following the financial crunch of 2008, many American companies went into a liquidity crisis and began to be unable to pay suppliers of semi-finished products. China took advantage of this, making them accept the conversion of debt to suppliers into equity shares, allowing a foreign power to enter the productive fabric of the United States, in exchange for being able to continue working.

The counter-reaction: Embargo on Chinese products.

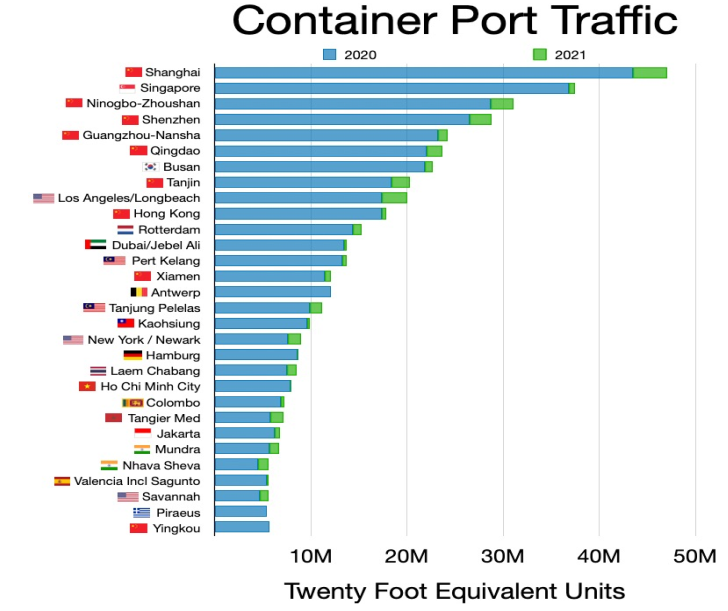

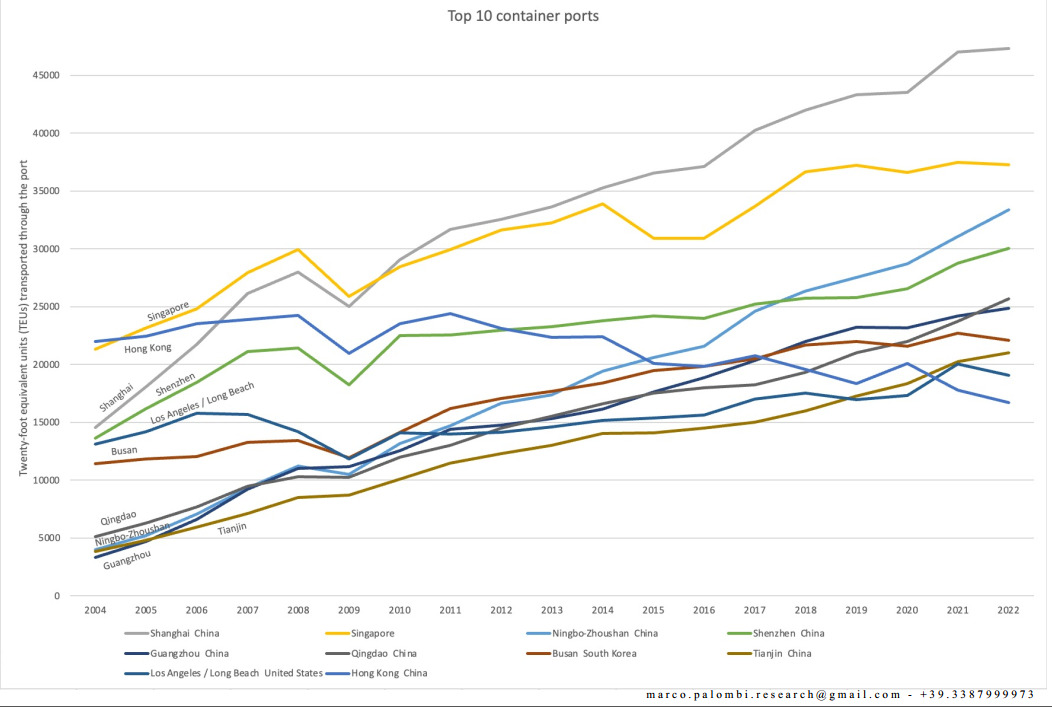

The counter-counter reaction: an attack to the core of Wests’s independency. Seven of the ten most important ports in the world are in China. That means that every vessel that shall travel to any other country, across the Ocean, sooner or later wuold pass through a Chinese

port.

But what happens if in the Chinese port there’s an unfortunate outbreak of a terrible disease?

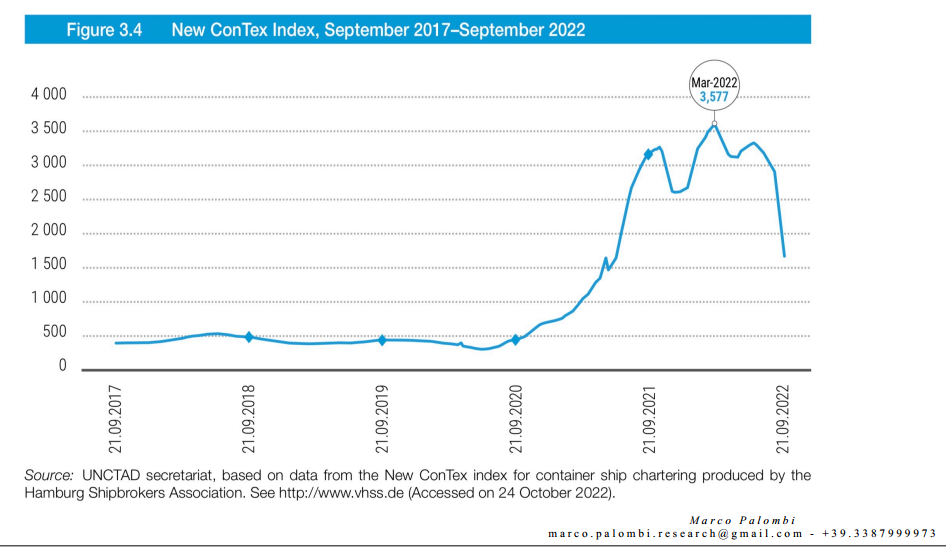

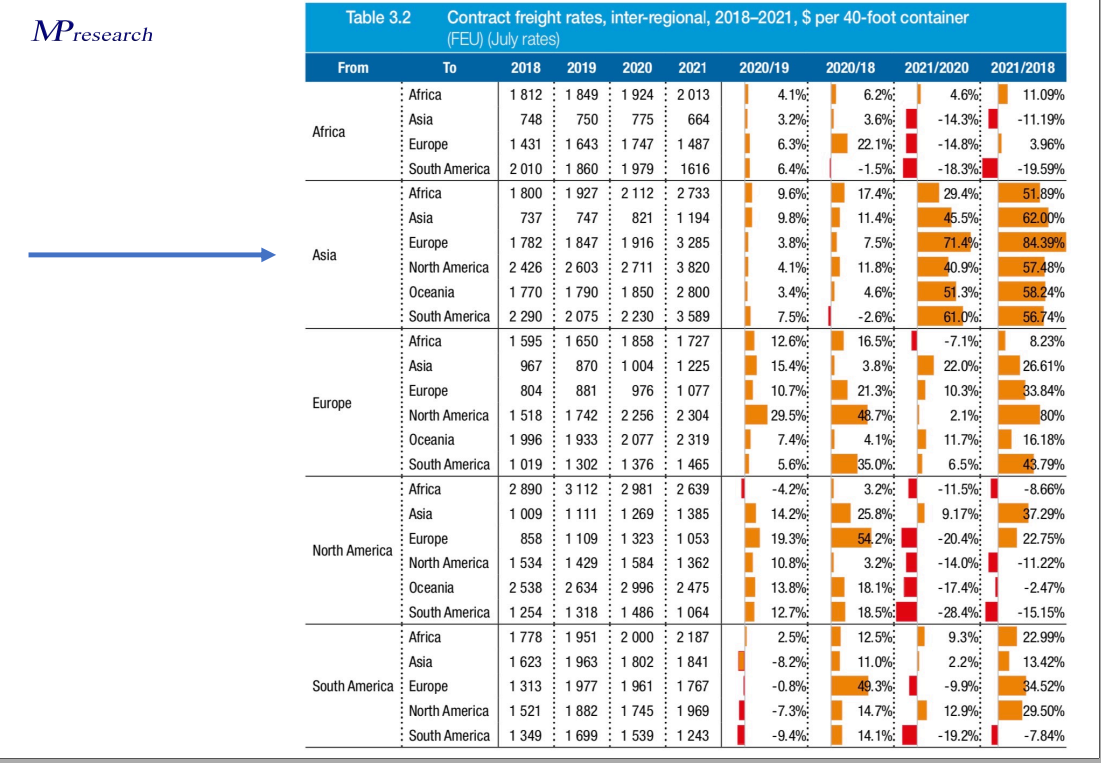

At the end of 2020, the average of a 6-12 month time rental for a 4,400 TEU "old Panamax" was $25,000 per day, but by the end of 2021 it had reached $100,000 per day. In addition, contract fixing periods have also lengthened and averaged 24 months in 2021, further reducing the availability of vessels.

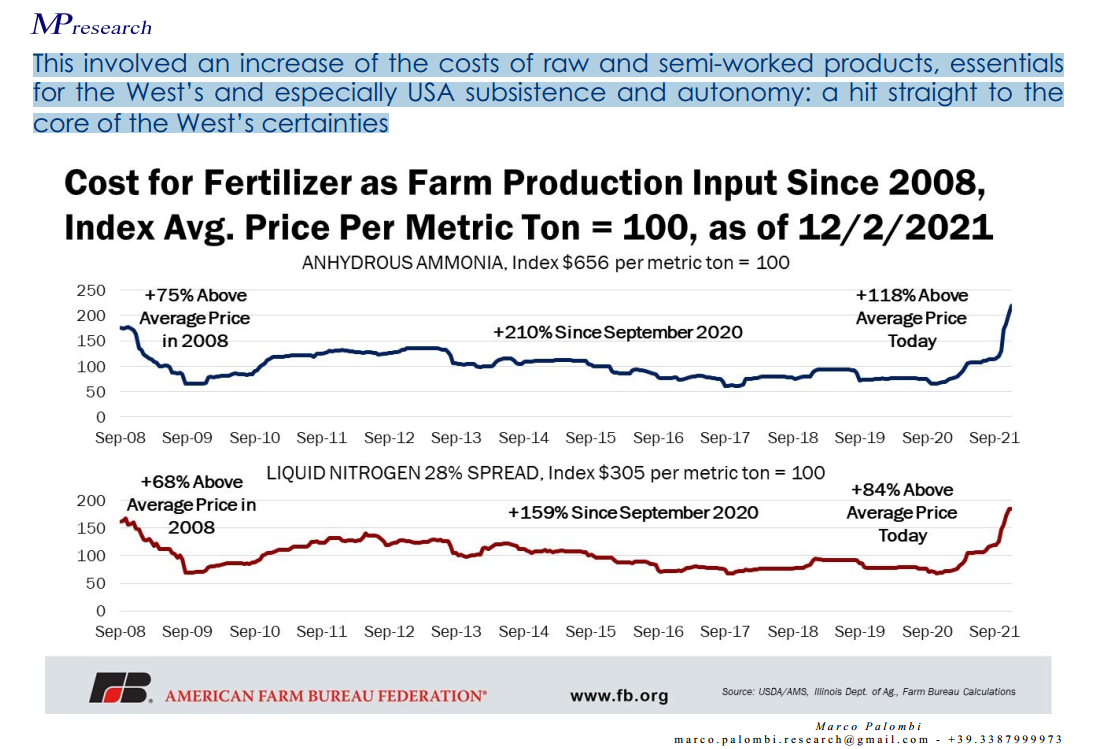

This involved an increase of the costs of raw and semi-worked products, essentials for the West’s and especially USA subsistence and autonomy: a hit straight to the core of the West’s certainties.

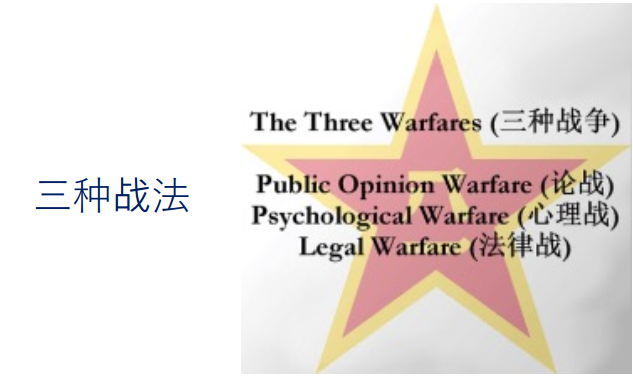

More, Covid has been used according to the Doctrine of the Three Wars: adoption of "Chinese" methods, antithetical to the values underlying the principles of Western democracy.

The counter-counter-counter reaction: an attack to the growth engine of Chinese Economy: the building sector

China, a developing nation, balances urban development in metropolitan areas with underdeveloped rural regions. The demand for housing in cities, driven by industrialization and population migration, stimulates economic growth. Real estate investment, fueled by

both individuals and local governments selling land-use rights, becomes a crucial revenue source. Despite financial dependence on continuous development, especially in infrastructure, it serves as a political tool to address economic crises. For instance, the 2008 financial crisis prompted a four-trillion-yuan stimulus plan, primarily directed at infrastructure projects. These projects contribute to stable GDP growth, making China's construction market a significant global player, representing 20% of worldwide investments in the industry. Rising incomes and urban migration drive residential construction demand in China, emphasizing affordable housing. Non-residential infrastructure, including healthcare and entertainment venues, is also set to expand. In 2018, Chinese construction firms signed around 50 trillion yuan in contracts. Key players include China State Construction Engineering, China Railway Group, China Communications Construction Company, among others. China Railway Construction Corporation reported a 25.07% increase in contract value for the first three quarters of 2019, rising to 40.3% in the third quarter alone, reaching 396.54 billion yuan.

Leverage, using credit to amplify business returns, becomes prominent in a growing market. It fuels the credit and financial system, generating liquidity. Everyone benefits as long as the market expands.

However, a decrease in housing demand poses challenges. Real estate developers rely on credit, anticipating future returns based on escalating construction contract values. The high debt level in China's construction system reveals its fragility while highlighting its role as a

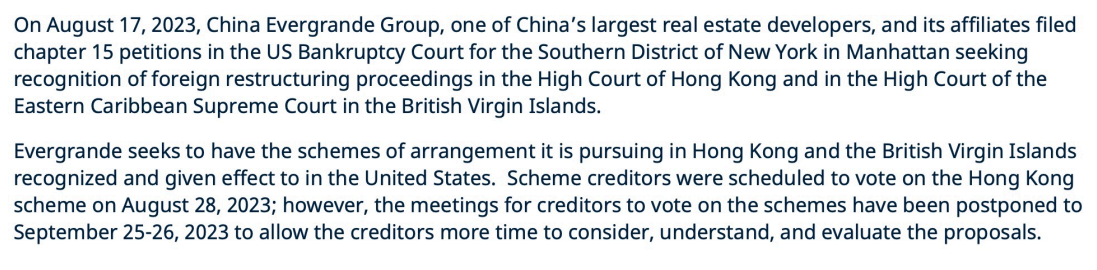

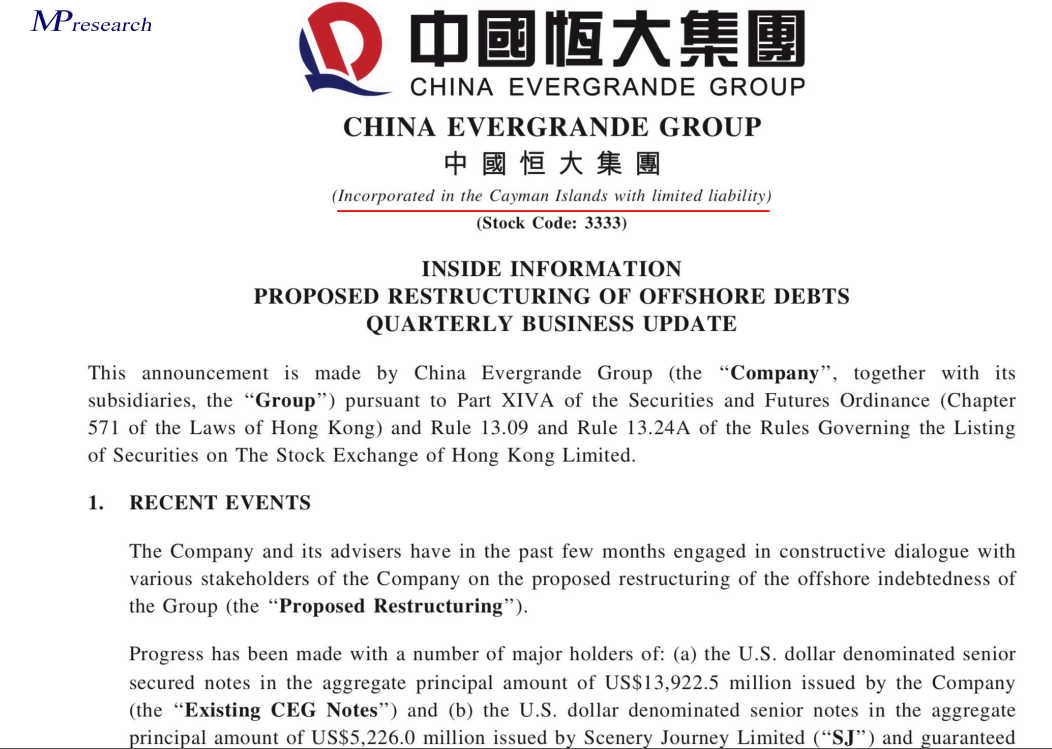

financial driver. For context, D.R. Horton Inc (NYSE: DHI), a U.S. giant, has a debt-to-equity ratio of 31.4%, illustrating the sector's economic influence. Unlike Lehman Brothers, companies like Evergrande rely on real assets, not securities. Beijing intervened in September 2021, using a 14-day Reverse Repo to address Evergrande's immediate liquidity issues, preventing a default the day before. This strategic intervention

aims to deter excessive debt reliance, signaling potential systemic risks in the real estatecentric economy. This confirms the importance of the Sector for China’s development.

The company was part of the Global 500, which means it was one of the largest companies in the world by revenue. Listed on the Hong Kong Stock Exchange and headquartered in the city of Shenzhen, it employed around 200,000 people. With the related industries, it is estimated that it used to maintain more than 3.8 million jobs each year. The group was founded by Chinese billionaire Xu Jiayin, who was once the richest man in the country. In recent years, Evergrande's debts, contracted to finance the Group's various activities,

have risen to the forefront of the pages of business newspapers as they have grown. Over time, the Group has become China's most indebted developer, with more than $300 billion in liabilities. In September 2021, it has warned investors about cash flow issues, which could lead it into default if it was unable to raise cash very quickly, due to "difficulties in finding buyers for some of its assets.»

Where these "difficulties in finding buyers for some of its assets.» were coming from?

The counter-counter-counter-counter reaction: use enemy’s laws to damage the enemy (one of the three warfares of the Chinese Doctrine)

Part Four - The Entry and Weight of Non-State Actors

Non-state actors pose a challenge to the effectiveness of state action, both when they are ignored and when they are used by the state system, which allows them to influence internal social dynamics, or when the state puts them on an equal footing, for example by declaring war on them.

Internal Weakness – Non-State Actors Intervention

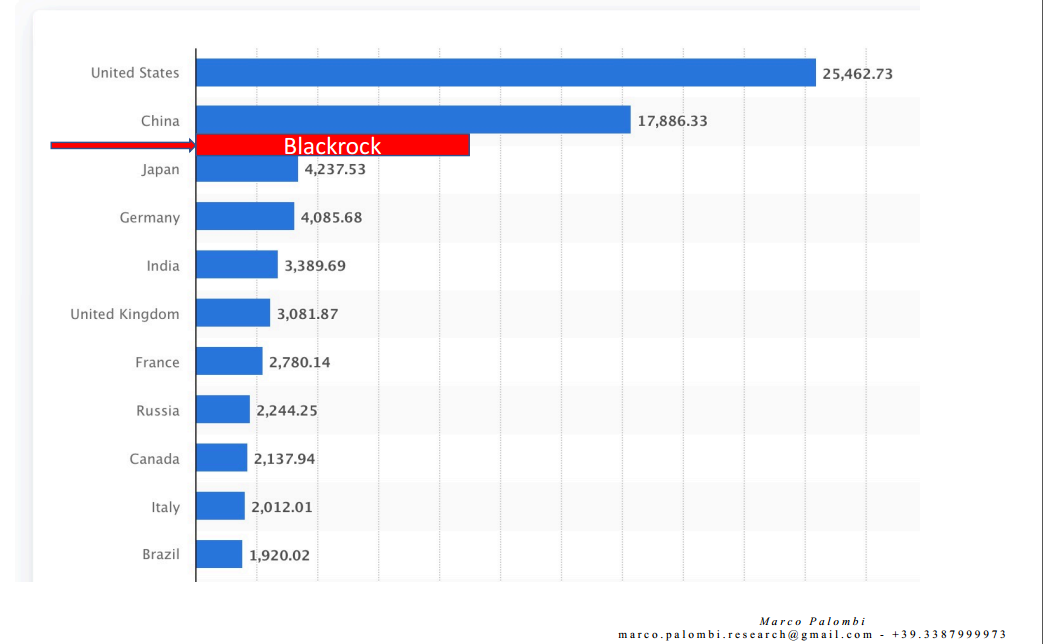

Blackrock's assets under management, in the trillions of dollars

GDP of major nations, in billions of dollars. Blackrock manages 4.69 times Italy's GDP

BlackRock has taken a strong push to the green. Now, the green has several facets:

- Companies use green ideology as a tool to artificially fuel demand for consumer and investment goods, manipulating consumer and investor expectations.

- Pressure for Regulation: Promoting stricter environmental policies can put companies with limited financial resources at a disadvantage, creating an environment of unfair competition where large companies have an advantage in adapting to new environmental regulations.

- Planned Obsolescence: Some companies encourage planned obsolescence by promoting new "green" products that make non-green ones obsolete, forcing consumers to replace their existing goods to generate additional profits.

- Concentration of Corporate Power: Green policies foster the accumulation of corporate power in the hands of large corporations, creating an environment in which larger companies can dominate the market and reduce the competitiveness of smaller companies.

- Social and Economic Impact: These policies are not able to avoid discrimination against smaller companies or less affluent consumers.

If constantly advocated in the media and on social media, thanks to polarization they become pervasive, and, in the long run, as demonstrated in the case of Italy, they create a disconnection between the people and the government.

Internal Weakness – Non-State Actors Intervention (no need to explain)

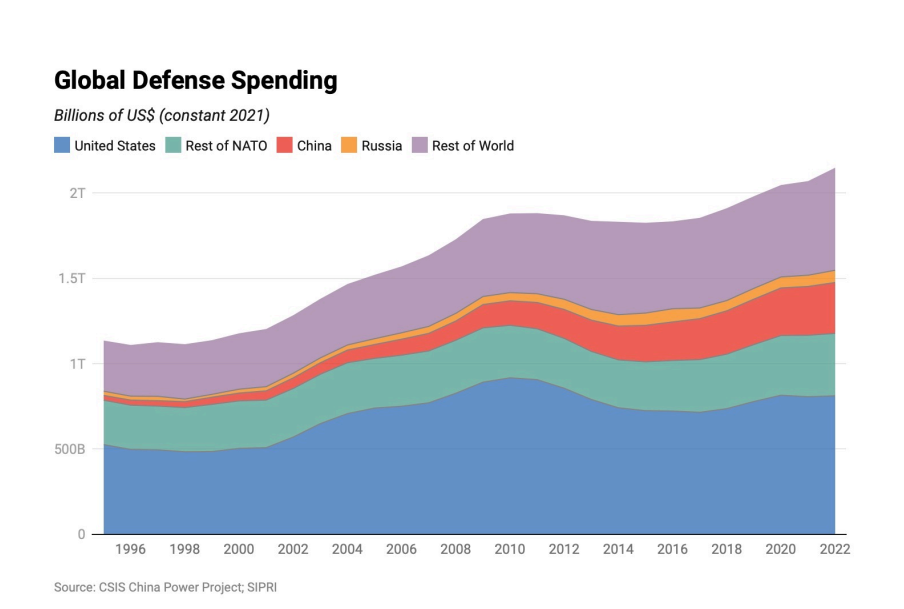

Part Five - Economic warfare is no longer enough

States are arming themselves.

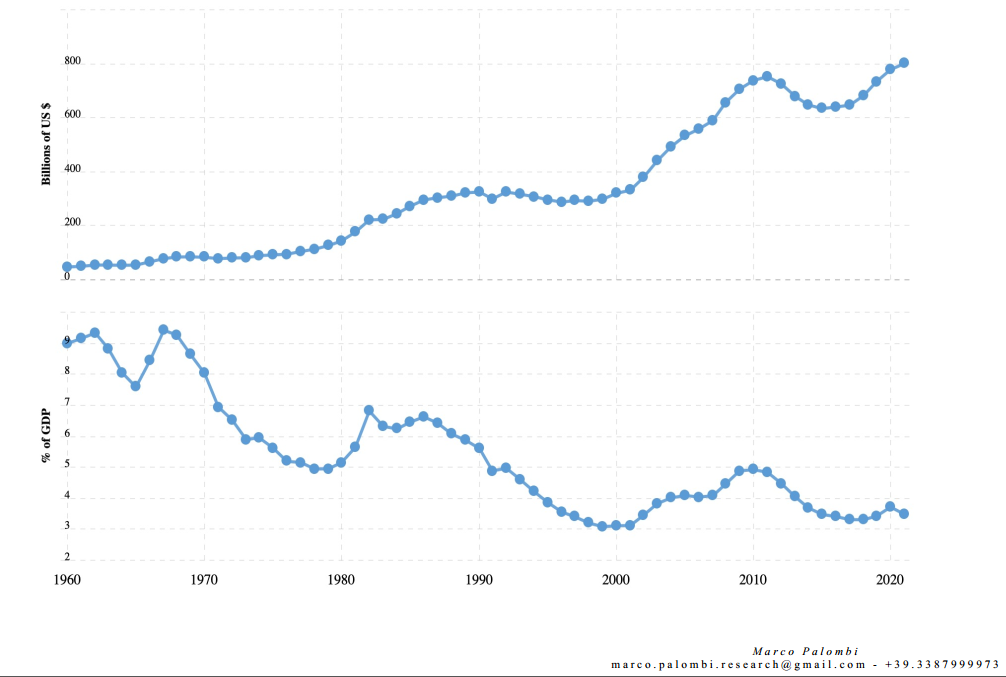

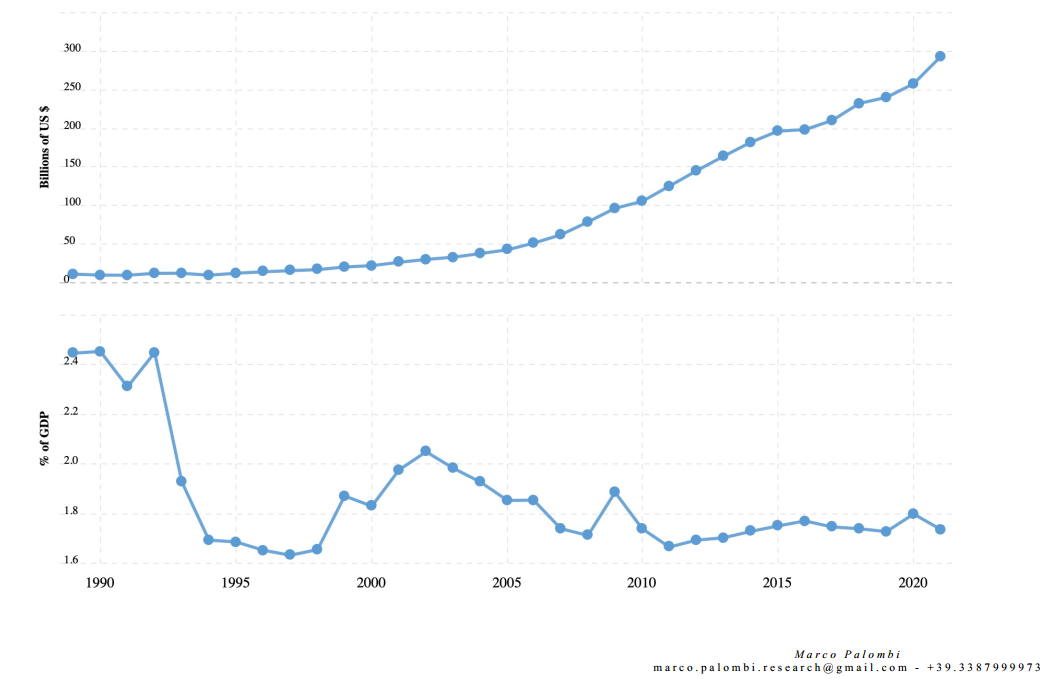

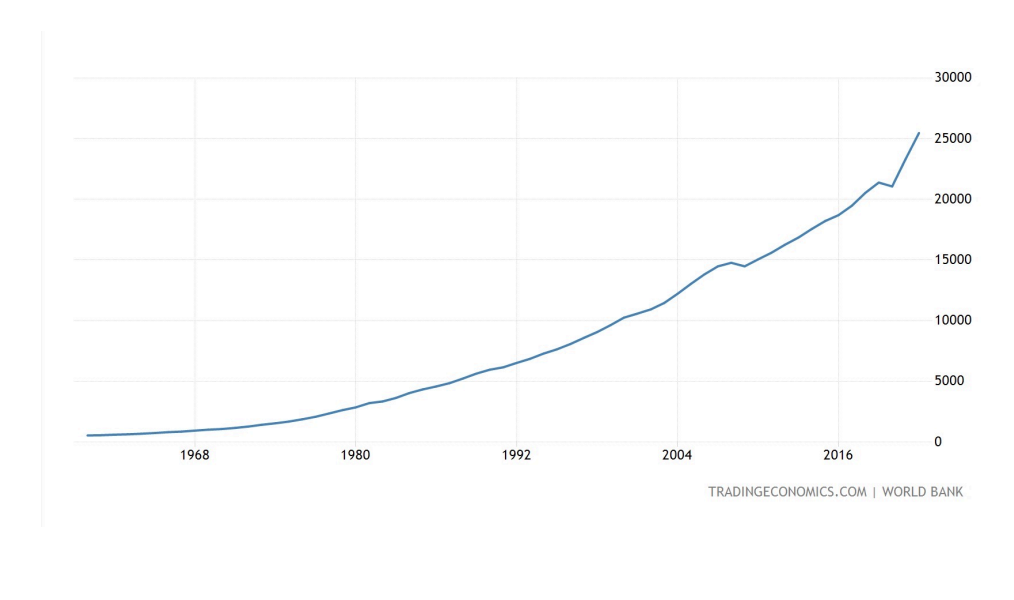

U.S. Defense Budget (source: World Bank)

The 2023 U.S. defense budget included:

- $56.5 billion for aviation. The funds are focused on fifth-generation F-35 fighters, F-15EX (a combination of fourth-generation aircraft with fifth-generation avionics), the B-21 Raider stealth bomber, additional airlifts, KC-46 tankers and drones.

- For the navy, there is $40.8 billion for the construction of nine warships, including a Ford-class aircraft carrier and two Columbia-class missile submarines.

- $12.6 billion for the modernization of Army and Marine combat equipment, including armored multipurpose vehicles, amphibious vehicles and ground drones

- $34.4 billion for the upgrade of nuclear weapons systems and the command, control and communications system.

- $7.2 billion earmarked for a battery of hypersonic missiles by 2023, sea-to-land hypersonic hypersonic missiles by 2025 and hypersonic cruise missiles by 2027 (they must catch up with the Russians)

- Another $24.7 billion goes to operational support and missile defense initiatives, including $892 million for Guam's defense against Chinese missiles.

- 11.2 billion for cyberwarfare

- $27.6 billion for Space, from the detection of missile launches to GPS satellites and for the reinforcement of satellite TLC systems.

This type of resource allocation is typical of the approach given to US foreign policy by the Monroe Doctrine, with its Roosevelt and Marshall

corollaries: projection of US’ force beyond national borders to combat threats to national interests.

The deployment of the solutions can start from 2024, but will not be completed before 2029. Speed is therefore the challenge that the US must face.

The National Strategic Plan for Defense states that the People's Republic of China (PRC) is the only competitor of the United States with the intent and, increasingly, the ability to reshape the international order. As a result, the

2022 National Strategic Plan for Defense identifies the PRC as "the challenge that must give time," according to the Department of Defense.»

(source: Military and Security Developments Involving the People’s Republic of China - A Report to Congress - Pursuant to the National Defense Authorization Act for Fiscal Year 2000, as amended) «Western countries, led by the United States, have implemented a pervasive containment, siege and compression against us, bringing serious threats to our nation's development never seen before.» (Xi Jinpin in a public speech in March 2023).

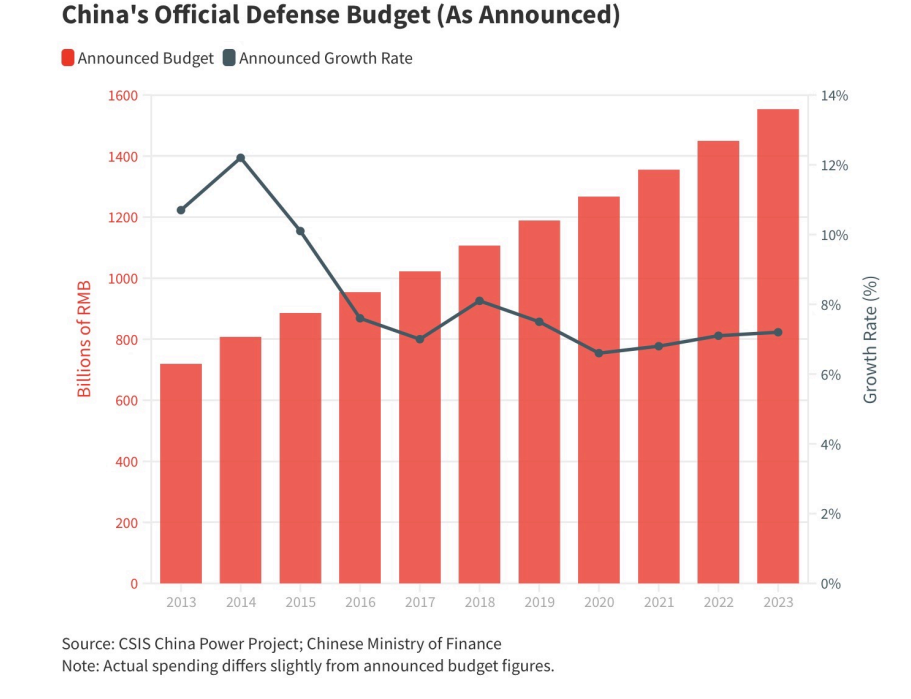

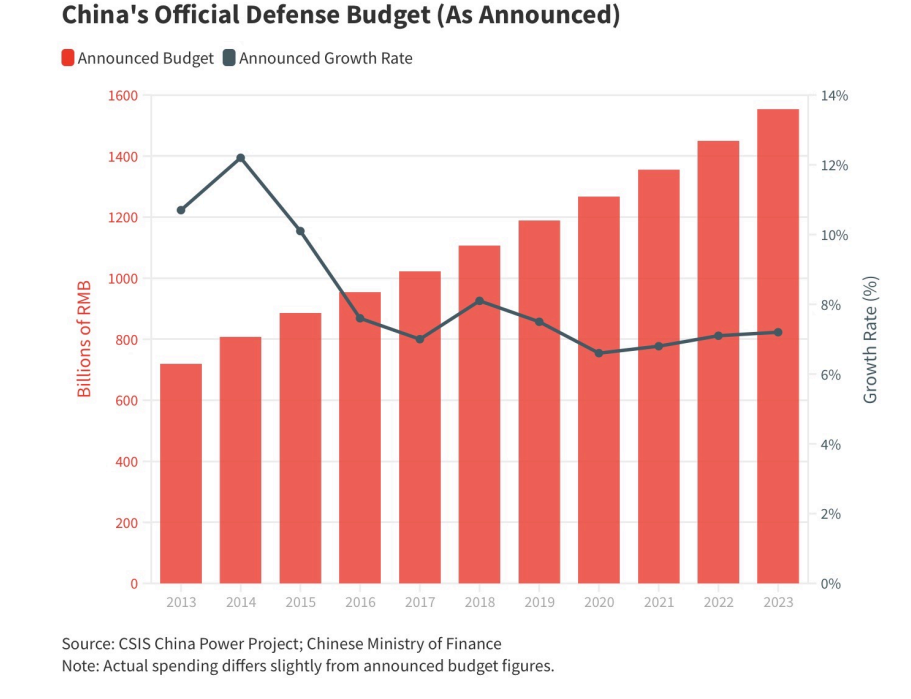

China's Defence Budget (source: World Bank)

The PLA uses its funds in a variety of ways, not only for armaments, but according to the Doctrine of the Three Wars:

Public opinion: what led to the joyful approval of Italy's adhesion to the Road and Belt initiative

Psychological Warfare: the covid pass, pressure on the sea around Taiwan

Legal Warfare: the Evergrande event, with the use of Chapter 15 against foreign investors.

From the point of view of the challenges China is facing, they are related to the concept of the five incapacities, introduced by Xi Jinping in 2015 as a specific criticism of the gaps and shortcomings that, according to him, plague some officers of the Chinese People's Liberation

Army (PLA). This concept represents a number of operational and decision-making challenges that, if not

properly addressed, could seriously compromise China's military capabilities in the event of conflict.

The "five incapacities" identified by Xi Jinping include: Inability to effectively judge situations: This inability suggests a lack of ability to quickly and accurately analyze situations on the battlefield, assess threats, and make informed decisions in response to the changing dynamics of a conflict situation. Inability to understand the intentions of higher authorities: Indicates a lack of clarity or understanding regarding the directives and intentions of higher command authorities. Understanding higher strategies and objectives is critical to the effective execution of military operations.

Inability to make operational decisions: This point highlights officers' difficulty in making quick and well-thought-out operational decisions in the field, which are crucial to success in military operations. Inability to deploy troops: Indicates a difficulty in organizing and deploying troops in an efficient and timely manner. This capability is essential for responding promptly to threats and

conducting military operations effectively. Inability to deal with unexpected situations: Represents the difficulty in managing and adapting to unexpected or contingent situations on the battlefield. The inability to react flexibly and effectively to unexpected events can seriously jeopardize the success of a military operation. Consider that China has had no direct battlefield experience for years, unlike the US.

Even for China, a time horizon of a few years still seems to be necessary to solve these critical issues. This is the direction of the talks between Biden and Xi: buying time.

Part Six - Towards a war economy?

During the war, the state focuses on producing goods and services necessary to lead and support the war effort. There are some common characteristics that economists often associate with a war economy. Mobilization of Resources: During a time of war, there is a massive mobilization of economic, human, and material resources. Economists Kenneth Arrow and Franco

Modigliani wrote in a 1954 paper: "War is the greatest challenge to the economic organization of a society.» Defense Oriented Manufacturing: In a war economy, production is primarily geared toward making goods and services necessary for national defense. Economists Paul Samuelson and Alvin Hansen, in their 1948 book "A Guide to Keynes," stated, "In a

time of war, the whole economy is directed toward the task of coping with the external threat.» State Control and Centralized Planning: During times of war, governments often take greater control over the economy. Central planning becomes commonplace, with state intervention in the production, distribution, and management of resources. John Maynard Keynes, one of the most influential economists of the twentieth century, emphasized the importance of government intervention in the management of the war economy.

Increase of the Government Spending: The war economy often involves a significant increase in government spending. Governments invest considerable financial resources in the production of military equipment, the training of armed forces, and other defense-related activities. The government is the largest client and the largest consumer of resources. Prioritizing War Production: Economists tend to emphasize that in a war economy, priority is given to the production of goods directly associated with the war effort. As John Kenneth Galbraith stated in his 1975 book "Economics and the Public Purpose": "In a war economy, the production of consumer goods is neglected in favor of the production of war goods."

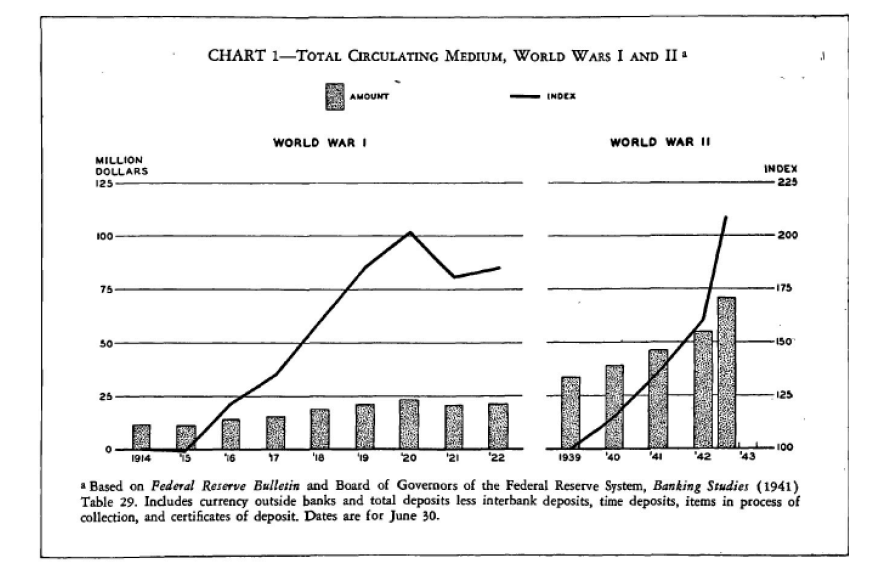

How do you finance a war?

War Taxes: One of the most direct ways to finance a war is through raising taxes. Governments can introduce new taxes or increase existing ones to generate additional revenue to support the war effort.

Confiscation of resources:

In extreme situations, governments can confiscate private resources, such as property or economic assets, to finance war. This measure has historically been used in times of emergency.

Reduction of non-essential expenditures: Warring governments often seek to free up financial resources by reducing non-essential expenditures in areas such as education, healthcare, shelf-goods and infrastructure not involved in the war.

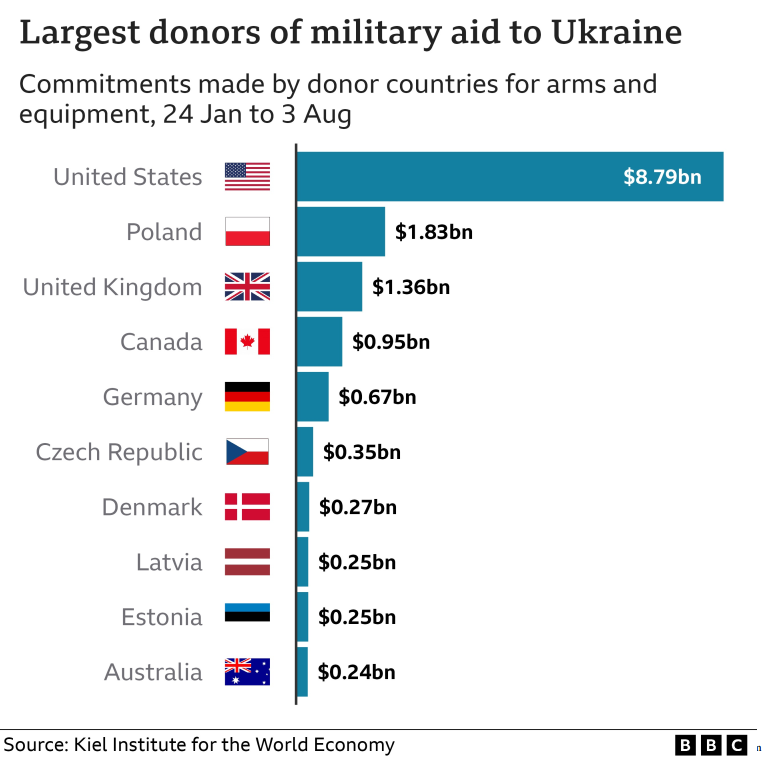

International contributions: In international conflicts, nations involved may receive financial support in the form of loans or direct donations from allied countries. This support can come from international organizations or bilateral agreements.

Loans: The issuance of debt securities is a common practice for financing a war.

Governments issue war bonds or other types of securities that are purchased by investors, financial institutions, or even citizens.

Debt monetization: A government issues new money to finance government debt.

In other words, the central bank creates new money to buy debt securities already issued by the government.

Currency printing and exchange rates control: Some warring governments may seek to control their currency and foreign exchange market to stabilize the economy and generate additional financial resources.

Capitolo 7 - Let’s look for an answer

And where do we look for it?

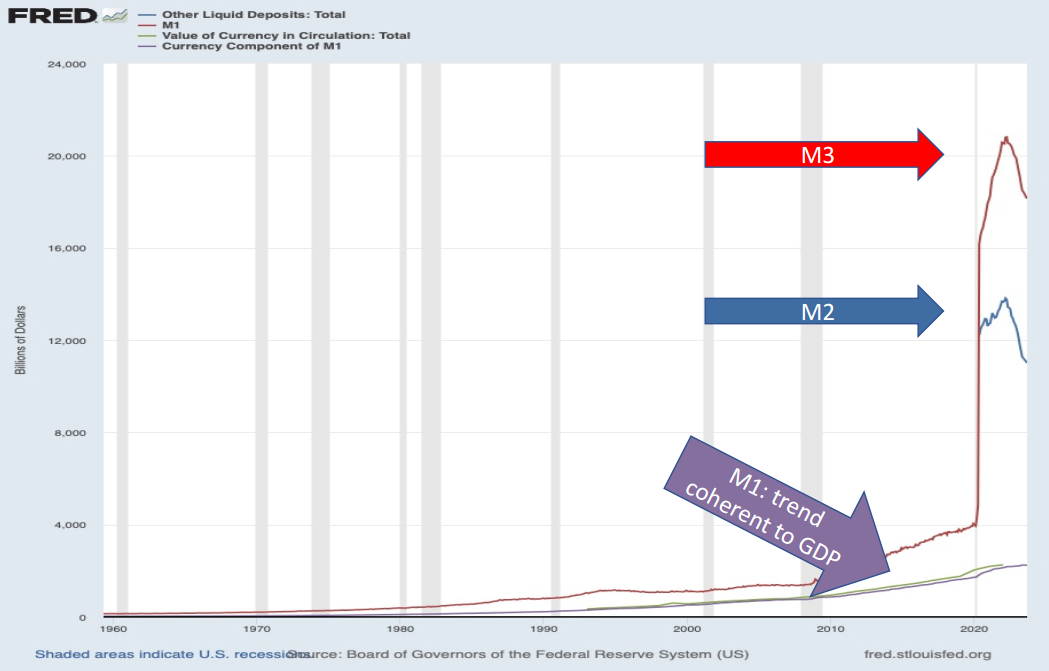

By verifying whether there are dyscrasias or disruptions between what normally happens in the economy, even if in a state of economic war and rearmament, and how moves any of the sensitive indicators. Let's take the Money Supply in our case, studying the dynamics of aggregates.

Monetary aggregates do not consider money as a medium of exchange, but as a

stock of value. They are referred to as M1, M2 and M3, and represent the different forms of a country's money supply. These classifications are used by economists and central banks to understand the overall availability and circulation of money within an economy.

1. M1:

M1 represents the narrowest definition of the money supply and includes the most liquid assets that can be quickly converted into cash or the cash itself.

Components:

- Currency in circulation (physical money, coins, and banknotes).

- Demand deposits (current accounts) with banks.

2. M2:

M2 is a broader measure of the money supply than M1, encompassing a wider range

of assets that are still relatively liquid.

Components: In addition to the components of M1, M2 includes:

- Savings accounts.

- Term deposits (e.g., certificates of deposit) with a maturity of less than one year.

- Non-institutional money market mutual funds.

3. M3:

M3 is the broadest measure of the money supply and includes a wider range of

financial assets, some of which may not be as liquid as those in M1 and M2.

Components: In addition to the components of M2, M3 includes M0:

- Large term deposits.

- Repayment agreements.

- Institutional money market mutual funds

U.S. GDP

Comparing the graphs of the money supply in circulation and the GDP of the United States, we see that monetary manoeuvres have always followed, not anticipated, the movements of GDP. The Fed's "passive" attitude mirrors the liberal ideal of the U.S. economy. However, if we insert the graph relating to M0 instead, the evaluation is different.

That is, the total money supply has had a different trend than that in circulation, favoring the accumulation of reserves. These reserves can be demobilized, as we have just seen, and can be used to support

an intense war effort, without excessively unbalancing inflation, if done with planned graduality. A far-sighted measure, if we plan to enter into a war.

Marco Palombi, December 2023.